Skills remain a key priority for manufacturers, with a report out today revealing that training budgets have not been hit by rising inflation.

86% of firms questioned in the annual In-Comm Training Barometer said that their spending intentions have remained unchanged, with more than three quarters investing in new technology to boost productivity – an 8% rise on last year’s findings.

The survey, which features the views of 113 bosses, also reveals that 61% are planning to take on an apprentice over the next twelve months, with 84% taking this decision to develop future engineering skills.

There has been plenty of debate about a disjointed national training picture that isn’t aligned for industrial needs, and this is clear from the report.

The vast majority (72%) believe that there isn’t enough national Government support for training, with 44% wanting better funding for apprenticeships and 39% to boost upskilling.

“The last twelve months have been dominated by global pressures outside of industry’s control, with a cocktail of difficulties, ranging from supply chain disruption and conflicts in Europe and the Middle East, to far reaching political uncertainty and high inflation,” explained Gareth Jones, Managing Director of In-Comm Training.

“With all these pressures in mind, we are pleasantly surprised that so many businesses have prioritised meeting their skills gaps over cutting budgets in the face of soaring prices.”

He continued: “In our opinion, this shows an overwhelming desire by our sector to support the development of apprentices and to address the burning issue of skills, making sure that a lack of talent – both now and in the future – is not a barrier to UK manufacturing making the most out of its recent resurgence.

“The stat around Government support is interesting and highlights a disparity with the local picture, which is a lot more optimistic and responsive to employer needs. The prime example here is a funding boost we received from the West Midlands Combined Authority (WMCA) to support the introduction of more modularised training, helping management teams overcome the issue of releasing staff from core operations – seen as the biggest barrier to training.

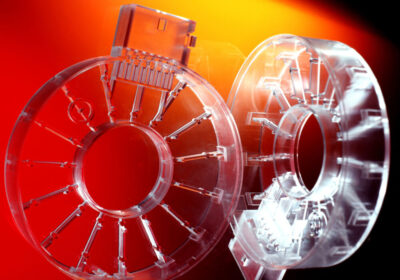

Localised skills funding has made innovative employment training programmes with Collins Aerospace possible.

“Local Skills Improvement Plans, supposedly set-up to drive industry-led investment on a national basis, have so far failed to support the direct funding of modular programmes. And this despite 83% of bosses saying they would take up the opportunity of modularised training if funding was in place!”

“Another area of concern is the vast amount of youth unemployment among NEETS (not in employment, education or training). Having access to funded training programmes – tailored to specific engineering needs – could really help get people into the hundreds of jobs currently available in industry.”

Reshoring – failing before it starts?

Last year, the In-Comm Training Barometer reported that just 28% of manufacturers had enjoyed reshoring success and, despite a campaign to promote the virtues of bringing work home, this figure has decreased to just 18% in 2024.

Nearly half continue to state that they don’t have the skills they need to make reshoring happen, which poses the question ‘what we can do to change this?’.

Gareth went on to add: “There is a big piece of work to be completed here; firstly, to understand what bringing work home looks like and then what support UK companies need to do to make this happen.

“This could be from the perspective of nearshoring their own supply chains or taking advantage of global customers looking to move work away from China, India, and volatile areas of the world.

“Skills and the whole productivity discussion will be so important here in deciding whether businesses actually want to battle for reshoring work or if it is actually easier to win work in domestic supply chains.”

61% of employers are still looking to take apprentices on over the next twelve months.

Artificial Intelligence (AI) – not in the training game yet

The impact of AI on skills doesn’t appear to be having a big impact on the companies surveyed in the barometer.

Just 6% of firms admit to embracing Artificial Intelligence to boost their skills. Whilst supply chains and back-office processes seem to be the main early adopters, there is still some way to go to educate businesses on how it can be used to develop workforces and support upskilling.

Gareth concluded: “I believe it will follow the same trajectory as Industry 4.0 and digitisation. Once slow to be adopted, data is the new gold and enabling companies to make informed real-time decisions and actions.”

To download the full report, please visit www.in-comm.co.uk or follow the company across its social media channels.