Rising energy prices, the impact of life after the EU and labour shortages continue to be the main challenges facing the UK metals sector according to a new report due to be launched next week.

Nearly a quarter of firms in the UK Metals Council’s State of the Metals Industry in the UK 2023/24 survey admitted to adjusting supply chain strategies or sourcing alternatives, whilst just under a third want enhanced Government support to navigate trade barriers and custom procedures in the wake of Brexit.

22% of manufacturers are also looking for improved energy supply contracts to bring prices down to more affordable levels, with just 31% of businesses saying that they have an effective recruitment strategy in place for filling the well-documented labour gaps.

There were positive sentiments in the report, which will be officially published during the opening address at the UK Metal Expo in Birmingham on September 13th.

Despite the widespread challenges, 70% of respondents are optimistic or very optimistic about future business prospects, underlining the resilience of the sector and its ability to innovate.

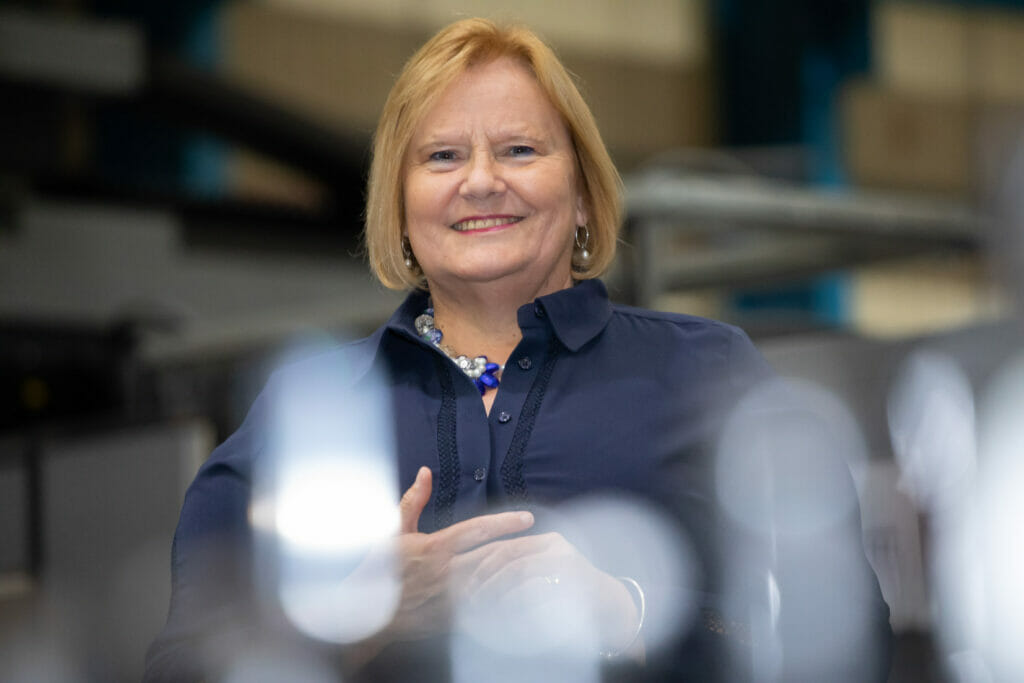

“We touch metals every day, whether that is in our homes, in the cars, planes and trains we travel in, the medical devices we rely on, as well as tools and machinery used for their production,” explained Rachel Eade MBE, Chair of the UK Metals Council.

Rachel Eade

“Importantly, it is now recognised that metals can be infinitely and readily recycled into new parts, something that cannot be said for many other materials in modern life – we need to value metals more as we move to a Net Zero economy.

“Foundation industries will continue to play a critical role in the way we all live, and this vital sector needs a voice to ensure that the Government understands the journey we are on.”

She went on to add: “This is why we came up with the State of the Metals Industry in the UK Report, a unique opportunity for us to canvas the views of primes, metal producers and those in the downward supply chain.

“The issues they are facing span from supply chain disruption because of Brexit to availability of raw materials and how they can mitigate the cost of energy – a key issue when you consider levels of consumption in our industry.

“Skills and the ability to get new people into our sector is also a challenge that is holding many of them back as they look to support the UK’s desire to move towards Net Zero. We’ll be highlighting this to Government at the UK Metals Expo next week.”

The UK Metals Council is made up of 12 trade associations from across the full spectrum of the metals supply chain, from primary manufacturing to recycling.

In total, it represents the interests and views of over 11,000 companies, employing directly and indirectly nearly one million people.

The first ever State of the Metals Industry in the UK Report was launched to provide a sector snapshot of the opportunities and challenges faced by the domestic metals industry and the prospects for future growth and sustainability.

It will be officially available from Wednesday September 13th and all the findings will be sent to Government to help it shape future policy and support, whilst the data will also be available for sector specialists, companies and academia to use for intelligence gathering, bids and lobbying.

Rachel concluded: “The UK Metals Expo is the perfect place to launch the report, with more than 200 exhibitors and 4000 industry professionals attending from 52 different countries.

“It aligns perfectly with the UK’s pursuit of Net Zero, depending as it does on advanced materials, manufacturing excellence and engineering innovation. A robust domestic metals supply chain is pivotal in realising our objectives, whilst driving energy-efficient production, nurturing circular economy practices, and propelling sustainable advancement.

“The findings from the report will be hotly discussed during the two days and we look forward to getting further feedback from delegates.”

For further information, please visit www.ukmetalscouncil.org.

- MRT Castings

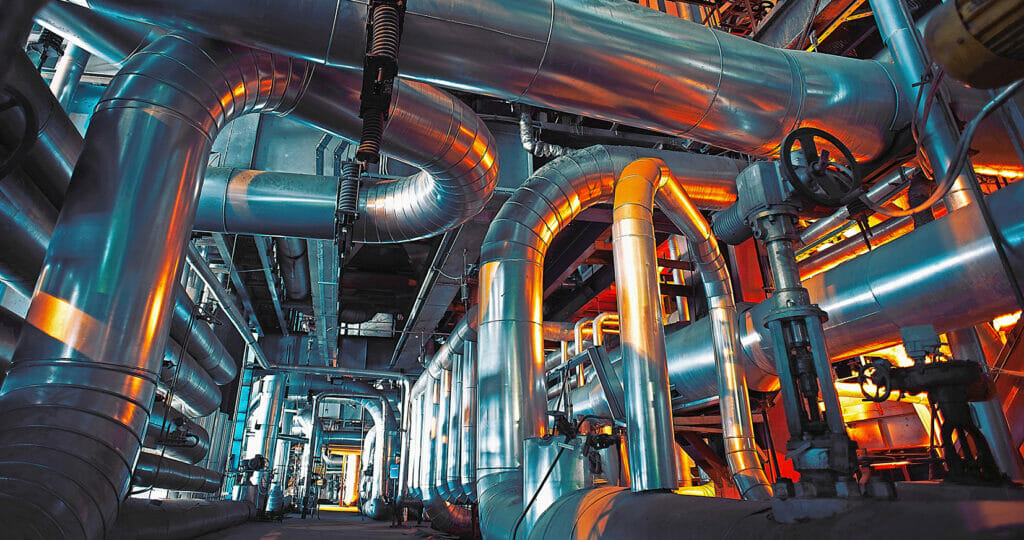

- Equipment, cables and piping as found inside of a modern industrial power plant

- Uk Metals report

- MRT Castings

Case studies from businesses who took part in the report:

Phil Rawnson, Managing Director of Andover-based MRT Castings, has seen energy prices treble over the last eighteen months.

His company exports over 60% of its £8.5m annual sales and the massive rise in costs makes trading overseas more difficult – especially when other countries aren’t hit with the same extortionate rises and delivery charges.

“We can’t pass all the increases on to our customers, so there is little doubt our global competitiveness has been hit.

“Whilst we have a continual focus on becoming more energy efficient as we drive towards Net Zero, we could certainly do with a more simplified support offer from Government.

“At the last count, there are 26 different support packages to help the move towards decarbonisation, but as a SME we don’t have the time or resource to uncover which corner of Whitehall they’re buried in.

“Bureaucracy is too heavy and costly, and this is definitely a barrier for firms to tap into the financial assistance that is out there.”

Brexit has also been a major issue for MRT Castings, which invested in one of the UK’s newest foundries in 2020.

Shipments to one of the company’s largest customers in Ireland used to take less than 24 hours, now thanks to an elongated and costly customs process the same journey is taking between three to five days.

Phil went on to add: “Our sector is extremely resilient, and we can achieve amazing things when we work together. Just look at what we did during the Covid-pandemic when we trebled our output – with the help of our supply chain – to support the ventilator effort that saved hundreds of lives.

“We don’t want handouts, just a level playing field.”

Mike Everard, Managing Director of Sheffield-based iESCO, has seen a significant surge in enquiries from the metal sector for his firm’s voltage power optimisation technology.

His company’s ‘powerPerfector’ product removes the overvoltage that UK mains electricity supply produces at source, helping businesses save money on energy bills, reduce their carbon footprint, and prolong the lifetime of their equipment.

“The resilience of the metals sector never ceases to amaze me and we are seeing first-hand how companies in the supply chain are being creative in order to reduce their energy costs.

“Whilst the rises we have seen are not ideal, I do think a certain amount of pain is required if we are going to achieve long-term energy security in the UK.

“It has focused our attention on what is required to help us reduce our dependence on carbon power and we now need to see the Government, hamstrung with the financial hit of Covid, channel sustained funding into creating more hydro, nuclear, solar and tidal power infrastructure.”

Kirsty Davies-Chinnock is quietly pleased that she has just negotiated a new fixed energy contract starting in October.

Kirsty Davies-Chinnock Managing Director of Professional Polishing Business Branding Portraits by Lensi Photography

The cost to Professional Polishing Services (PPS), which offers bespoke stainless steel and non-ferrous polishing, will be an additional £100,000 per year, an 84% increase on the previous rate.

“I’ve spoken to a lot of MDs I know, and they’ve been tied into contracts that are 300-400% more than their last ones – that is unthinkable.

“Even at 84% we are going to have to pass some of the additional costs on to our customers and we’ll work with them to do this, whilst also implementing the energy efficient measures we can on our own shopfloor.”

PPS Ltd works with a client base that spans the world, with its efforts seen as far afield as Hong Kong and Australia.

One of its biggest clients used to be in Ireland, but due to the complications of Brexit annual sales in this territory have reduced from £250,000 to just £30,000 per year.

“Trading with the European Union is more difficult and some of our customers have chosen to source elsewhere. We’ve had to react and look at building sales in other existing markets and we have been successful in winning new work in the US and Saudi Arabia. That’s not as a positive result of Brexit, we were trading in these areas whilst still in the EU.”

Despite the challenges, Kirsty is optimistic about the future and has a strong pipeline of opportunities.

In fact, she has just secured a £250,000 new order to take turnover past the £2m mark in what is currently her firm’s 40th anniversary year.

“We’ll need another person to help with our growth and that’s not always easy in our sector due to the diminishing labour pool. We’re quite niche, so need to find the right person with the right culture and then we train them up in what we do.”