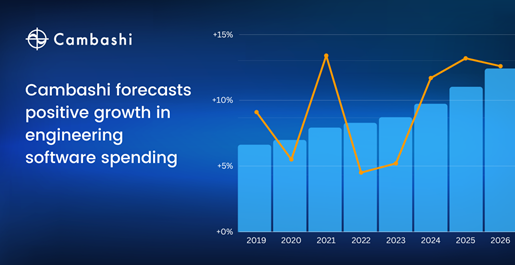

Our latest update of the market database of engineering software spend (Feb 2023 release) indicates that, despite a challenging global economic situation, positive high single-digit growth is forecast in 2023. Last year finished more strongly than expected, with many vendors increasing their prices during 2022. Many providers showed impressive resilience in the TAM data results during 2022.

The update reveals that inflation, reduced real income, and uncertainty in the economy will lead to reduced growth in demand across industries, resulting in lower than previously expected engineering software expenditure. For 2023, forecasts vary depending on the industry sectors that vendors address, leading to variations in Cambashi’s vendor-specific forecasts. Contact us to learn more about the fastest-growing software segments and crisis-resilient software providers: cambashi.com/contact-us/

Our most recent forecast, shown in RED, was corrected according to the predicted recession for 2023. Cambashi still forecasts strong high-single-digits and positive growth in engineering software spending (CAD, CAM, CAE, PLM, BIM).

Even during the worst lockdown periods caused by the COVID pandemic, CAD/CAM/CAE/PLM/BIM software markets revenue growth remained positive – and then rebounded quickly to around 10%. These software markets have proven to be resilient against economic downturns, but this varies by segment, product, country, and industry.

Want to learn more? We would be happy to arrange a half-hour briefing with our market expert.

Cambashi now provides a Market Due Diligence and Software Market Update service to its clients. Download our latest (March 2023) software market update slide deck, which covers:

- Total Market Size by Segment (2023)

- Segment Performance and Forecast in Constant Currency

- Market Drivers

- Drivers of Key Players

- Manufacturing Software Market Share – Top 5 Providers

- Manufacturing Software Provider Performance and Forecast

- Manufacturing Software Top 5 Providers – Trends

- BIM Design Software Market Share – Top 5 Providers

- BIM Design Software Provider Performance and Forecast

- BIM Construct Software Market Share – Top 5 Providers

- BIM Construct Software Provider Performance and Forecast

- AEC BIM Software Trends – Top 5 Providers

- Observations

Meanwhile, a big market driver is the focus on sustainability. This, combined with PLM, is a key enabler linking disciplines, technologies, and value networks to optimize products for a circular economy.

Manufacturing software providers such as Autodesk, Dassault Systèmes, PTC, and Siemens have been positioning PLM for many years as a total life-cycle support environment. Any approach to sustainability requires not only an end-to-end approach to product development but also a closed-loop one at multiple stages of the life cycle. PLM should be seen as a key enabler to sustainability, linking disciplines, technologies, and value networks to optimize products for a circular economy.

Our research data reveals that disruption is particularly evident in the area of BIM (Building Information Modeling) software. BIM is the foundation of digital transformation in the architecture, engineering, and construction (AEC) industry, and incorporates three key areas:

- BIM Design, which includes software for the design of building and infrastructure projects

- BIM Construct, which covers software for collaboration on planning and building

- BIM Operate, which includes software for facilities management.

Read our recent white paper Construction Software Market: Why We Are Seeing Significant M&A Activity, written by our senior consultant David Land.

The Cambashi Employment database contains detailed information on the size of potential user communities for engineering software (BIM, CAE, PLM, CAD/CAM, etc.).

For example, the data shows that worldwide, there are over of 300 million people employed in AEC industries directly, or in AEC-related occupations in other industries. This represents a significant potential opportunity for makers of BIM software. The composition of these people is key to understanding where the opportunity lies and the potential for BIM software growth. Learn more about Cambashi Employment Observatory.

The world economy has undoubtedly suffered a series of downturns over the years, the global pandemic being the most recent. At Cambashi, we have found that engineering and manufacturing software providers have sustained growth through these downturns. Based on our analysis the expectation is that software providers will continue to grow over the next five years, despite current economic volatility.

Read the full article Challenging Times – But Room for Optimism, written by Alan Griffiths, Managing Consultant at Cambashi.

With the massive energy transition happening, it’s perhaps no surprise that people involved in business communications with Oil & Gas, and Chemical companies, from CEOs to sales and marketing managers, are finding it hard to keep up with trends and challenges impacting the sector. For that reason, learn more about our tactical industry intelligence, linked to the latest industry news, trends, and challenges.

So, what is the current position of the Oil & Gas market and the industries it serves?

For anyone selling into the Oil & Gas and Chemicals industries, it`s important to understand the industry challenges — read the article Oil & Gas and Chemicals Industries – Drilling Down into Challenges and Opportunities or find more information across a variety of industries – Access Cambashi’s Industry Insights.